THE DEAL:

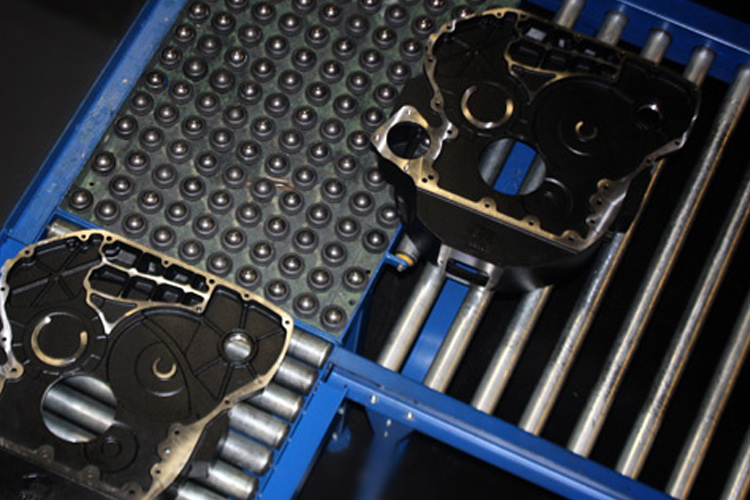

The acquisition of Alumasc Precision Components (APC) by Shield Group for a cash consideration of £5.8m. Following Alumasc’s decision to focus on its building products activities it was seeking a buyer for APC, the larger of its two engineering products businesses. Leicestershire-based Shield Group supplies precision engineered aluminium components to the off highway diesel and automotive markets with certain common customers to APC. APC’s employees have transferred to Shield while its legacy pension obligations were retained by Alumasc. Shield has indicated that it intends to invest in and develop the APC business at its current factory near Kettering.

OUR ROLE:

We assisted Shield Group with the assessment of, and formulation of an offer for, APC which had itself generated an operating loss of £1.4 million in its most recent financial year but which offered significant strategic and financial synergies to Shield Group including having £6.5 million of net assets. Shield utilised existing cash reserves and credit lines to finance the acquisition with Cattaneo continuing to act as a sounding board to Shield as the transaction progressed to completion.

WHAT OUR CLIENT SAID:

‘Shield has enjoyed a long relationship with the Cattaneo team who have assisted us with previous acquisitions and investment projects. While the strategic benefits of a deal were clear to us it was vital that we drew upon Cattaneo’s trusted judgement to provide an objective assessment of our assumptions and to structure an offer which would be worthwhile to the seller while preserving the benefits for Shield.’

Chris Shield, Managing Director, Shield Group